A New Report from Nasdaq Verafin Unveils Alarming Insights on Financial Crime in Europe

Explained

In a groundbreaking report titled “Financial Crime Insights: Europe” Nasdaq Verafin pulls back the curtain on the staggering scale of financial crime plaguing the continent. Drawing from their 2024 Global Financial Crime Report and insights from anti-financial crime experts in the EU, UK, and Nordic regions, the findings are nothing short of shocking.

An estimated $750 billion in illicit funds is believed to have infiltrated Europe’s financial systems, representing a troubling 2.3% of the continent’s entire GDP. This figure paints a dismal picture of the fight against financial crime across Europe.

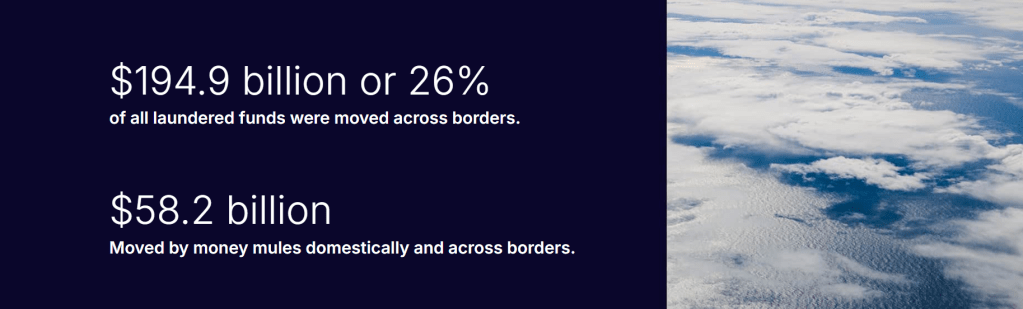

One particularly alarming revelation is that of the total illicit funds, a staggering $194.9 billion was tied to cross-border transactions. This emphasizes the critical need for international collaboration in the ongoing battle against these illegal financial flows.

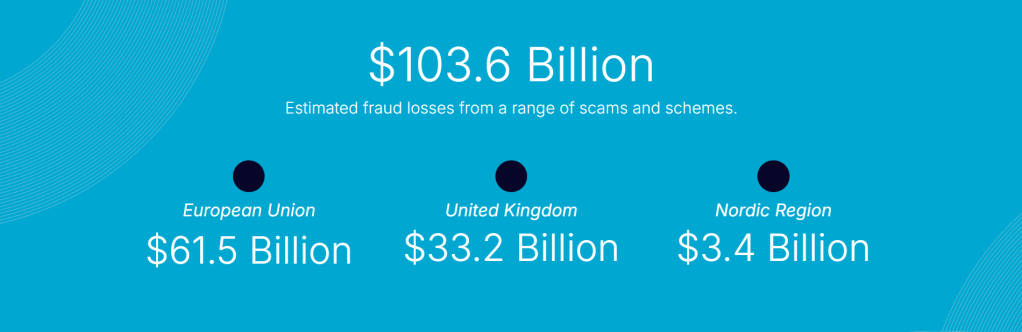

Fraud in its various forms—from sophisticated scams to direct bank fraud—has wreaked havoc, with losses estimated at an eye-watering $103.6 billion. This poses a significant threat to the financial health and integrity of the European market.

Stephanie Champion, Executive Vice President and Head of Nasdaq Verafin, underscored the pressing need for a united front among industry leaders. “Now is the time for stakeholders to unify their efforts and build on the positive momentum seen across Europe. We must commit to making a decisive impact in our fight against financial crime,” she stated. “Criminals operate without regard for borders or regulations. By aligning our goals, we can fortify our economies and protect the broader financial ecosystem.”

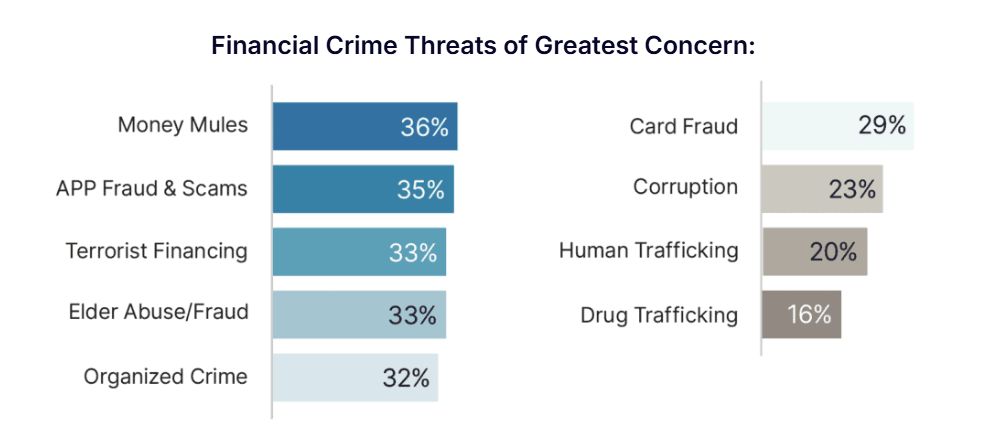

The report goes beyond numbers, shedding light on the broader societal implications of financial crimes, including elder abuse, human trafficking, drug trafficking, and financing of terrorism. It advocates for a multi-faceted approach to combat these threats, emphasizing enhanced anti-money laundering protocols and innovative fraud prevention strategies.

Nasdaq Verafin, equipped with a powerful suite of cloud-based financial crime management tools, is stepping up to support over 2,600 financial institutions stewarding $10 trillion in assets. By harnessing AI-driven solutions and a unique consortium data approach, the firm is on a mission to bolster payment fraud detection, streamline compliance, and enhance the effectiveness of measures against financial crime.

Europe stands at a crossroads. The time to act against fraud is now.

Source:

Reports from Nasdaq Verafin, Learn More→